Installment Receivables

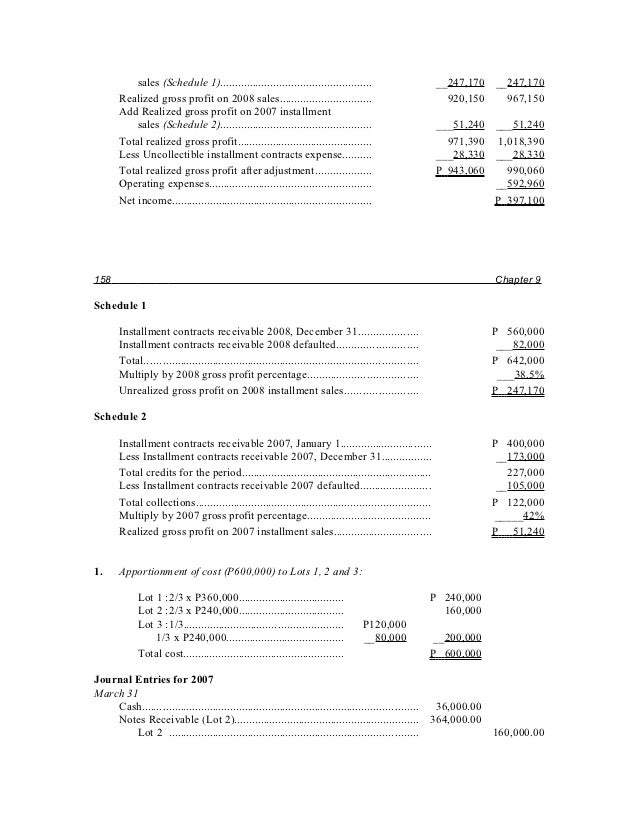

Journal entires:At the First Period of sale:(a) Dr. Installment sale A/R (whole amount) $500,000Cr. Inventory (at cost) 200,000Cr. Deferred Gross profit (install sale - inventory cost) 300,000(b) At Cash collection:Dr. Cash 150,000Cr. Installment sale a/r 150,000. Here increase cash and reduce installment sale receivable(c) when record profit at collection:GP% = $300,000 profit / $500,000 sale = 0.60 or 60%Then: $150,000 Cash Collection x 0.60 = $90,000 Gross profitDr.

Deferred Gross profit 90,000Cr. Realized Gross profit on installment sale 90,000.Dr. Deferred gross profit - reduce deferred gross profit. Cr.

Realized gross profit - recognize and/or increase at each cash collection date. Statement #1: 'When collectability of installment accounts receivable is reasonably predictable.' This means: Reasonable predicable on collecting installment accounts receivable results in actually recognizing realized Revenue (revenue when it's earned and realized = revenue where good/service is finished and finally collect the cash and/or A/R)Statement #2: 'When installment sales are material and there is no reasonable basis for estimating collectability.' This means: Installment sales method is used when the method of installment sales is material (it's very important for financial reporting purposes and greatly impacts business operations to use the Installment sales method) and installment sales methods' main purpose is that it is used when a company has no way to determine when cash is really, really going to be collected (hard to estimate when cash is going to be collected). Also: the installment sales method is also used when it's impossible to establish a reasonable bad debt percentage.Statement #3: 'when it is doubtful that the amount due will be collected.' This means: Cost recovery method is used when when it's doubtful that the amount (sales installment amount) will be entirely collected.

You cannot use installment sales method since installment sales focuses on unable to estimate an amount to be collected in determing an amount of bad debt expense whereas Cost recovery focuses it's doubtful to recover the entire sales amount. When have a CPA exam problem that looks like this:Year 2 Year 1Sales $2,500,000 $1,000,000Accounts receivable:2002 sales 9 sales 540,000 600,000Deferred gross profit:2002 sales 2 sales 108,000 120,000(a) Why do you not combine Account receivables' 2002 sales and 2001 sales under Year 2 (800,000 + 350,000); Deferred G.P.' S 2002 and 2001 sales under 2 ($150,000 + 112,000?(b) Also: how come in this scenario, you do not have: Sales minus A/R then divided by total sales for either year 1 or year 2? Scenario: Find the Realized gross profit to be reported on income statement for year-end with the following data:. Yard Company sold a planet to Grass Inc for $2,500,000 on Jan 2, year 1. On that date (Jan 2, year 1), plant's carry cost = $1,000,000.

Also, Grass Inc gave Yard company $250,000 in cash and a $2,250,000 note on 12% interest rate. This $2,250,000 is payable in 4 annual payment of $562,500.

On Dec 31, year 1, Grass Inc paid 570,000 that includes interest. Yard company uses Installment Sale method to record revenue. Amount realized $125,000Adjusted basis -65,000Gain recognized 60,000Gross profit% (60,000 / 125,000) = 0.48Amount realized $125,000Less: collections in Year 1 (35,000)Less:Principal collected in Yr. 2(45,000- 15,000 interest.) (30,000)Balance to be received 60,000 End receiv.x GP% x 0.48Deferred gross profit $28,800. Interest is recorded separately as Interest income. This interest income is not included or added back in to determine Deferred Gross Profit or Realized Gross profit.FYI - On 12/31/Year 2 Balance SheetInstallment Sale Receivable 60,000Less: Deferred Gross Profit (28,800)Balance $31,200.

Use the first entry box to specify the default interest rate percentage.The field accepts 4 decimal places. This is the interest rate thatis used when calculating interest if the rate is not specified inthe Sales Tax Settings or Installment Payment Plan. This rate is thelast one checked in the interest rate hierarchy. ( )If you specify an interest rate percentage here, you must use theCalculation entry box to specify the type of calculation.

Click theArrow button and select either DecliningBalance (APR) or Straight Line Interest.Use thismandatory setting to specify the default term length, in months. Whencreating new installment contracts inentry, the term for the new contract defaults from the or from this control setting if no term is specified for theplan.Use thismandatory setting to indicate the minimum allowable term, in number ofmonths. If you do not specify a minimum term in the, this setting is used.Use thismandatory setting to indicate the maximum allowable term, in number ofmonths. If you do not specify a maximum term in the, this setting is used.When creating an installment contract inentry, the term defaults from the plan settings or from these controlsettings. If you enter an override to the default terms, your entry cannotbe less than the minimum or greater than the maximum established hereor in the plan settings (if any).Use this mandatory settingto specify the number of months following contract activation that thefirst installment payment is due from the customer. The system uses thissetting and the contract due day to determine the date the first paymentis due.(LOCKED - STORIS accessONLY!) This mandatory setting indicates the number of days after the installmentcontract's due day that a payment can be made before a late fee is assessed.Use this optional setting to list the days of themonth to be offered as possible customer due days during contract creation.Click the Action button at this setting to access a window in which you check the boxes for all the possibledue days, from 1 through 28. The days you specify in this setting populatethe drop-down at the Due Day field on the entry.

If multiple days are selected, the default is theday that is closest to today's date.Use this optional settingto indicate the maximum number of days in the future that a due date canbe changed beyond the current due date. For example, the current due dateis June 1 and this field is set to 10. The due date can be pushed to June10, but not to June 15.This optionalsetting can be used to establish a table of deferment fees to be assessedwhen you defer installment payments for a contract. Click the Action buttonto access the window, where you can create and maintain the table.

Installment Sales Balance Sheet Presentation

Ifyou do not create a table, deferment fees are not assessed.Indicate the number of consecutivedeferments allowed on installment contracts.Indicatethe number of allowed on a contract within a rolling 12 month period.Clickthe Arrow button and select the interest rebate calculation method. Chooseeither Calculation method used in installment receivables in which insurance, interest, and principal amounts are calculated from the payment amount each month over the term remaining. Or Calculation method used in installment receivables in which the interest, insurance, and principal amounts remain the same each month, based on the Installment payment amount. Entryin this field is mandatory.Use thisoptional setting to indicate the number of 'full interest and insurancerebate' days.

If a contract is cancelled within this number of daysafter contract activation, full interest and insurance rebates are calculated.Use thisoptional setting to indicate the number of 'return cancellation'days. If a FULL is entered within this number of days after contract activation,the installment contract can be cancelled.Use thissetting to enter the maximum dollar amount that can automatically be creditedto a contract as the result of a,(for less), or.Use this mandatory setting to limit how far intothe future your selected date can be, when you choose a fixed contractactivation date during entry. Enterthe maximum number of future days here; the maximum entry for this settingis 99 days.Indicatethe maximum number of days you can back-date a payment so that it fallswithin the payoff 'as of' period. AdvancedTo activatesettings on this tab, check the box next to each setting or check thebox in the header row to activate (check) all settings listed. You canchange a setting to inactive by clearing the check from the check box.To clear all check boxes, un-check the box in the header row.To permitchanges to the due date for installment payments that have been deferred,check this box. Otherwise, leave the box blank.To permitchanges to the due date on contracts with past due payment amounts, checkthis box. Otherwise, leave the box blank.To permitmultiple due date changes on an installment contract, check this box.Otherwise, leave the box blank.To promptusers to print insurance letter(s) during, check this box.

Otherwise, leave the box blank. Checkthis box to consolidate and print insurance letters whose insurancecodes' form templates for the customer's jurisdiction match. Toprint one letter per insurance code, leave the box blank.In order to use this setting, youmust check the box at the INSURANCE - Prompt the User to Print theInsurance Letter.To roundup regular monthly payment (excluding final payment) amounts to the nearestdollar, check this box. Otherwise, leave the box blank.To allow multiple pendingcontracts to exist for a customer, check this box. Otherwise, leave thebox blank.To updateand generate installment statements during installment cycle processing,check this box. Otherwise, leave the box blank.

To apply additionalpayments to the beginning of the installment contract, check thisbox. Otherwise, leave the box blank.When the box is left blank, the additionalpayments are applied to the end of the contract, in last installmentto first sequence.

Payments continue to be cycled due on the due date,but by applying the payment to the end of the contract, customerscan pay off the contract in a shorter amount of time.If you check the box at this setting,additional payments are applied in payment due sequence. This allowscustomers to pay ahead on future payments due. For example, paymentsdue are $100. The customer makes an additional payment of $300, whichis applied to the next 3 payments in advance. The customer does nothave a payment due for 3 months.Installment payment reversals arealways applied in last installment to first sequence. This field allows credits to installment contracts to be appliedas a pre-payment (checked) or posted to the end of the contract (unchecked).If this box is checked, additional paymentsare applied to the beginning of the installment contract. Additionalpayments are applied in payment due sequence.

Installment Method Vs Cost Recovery

This allows customersto pay ahead on future payments due. For example, payments due are$100. The customer makes an additional payment of $300, which is appliedto the next 3 payments in advance. The customer does not have a paymentdue for 3 months.If this box is unchecked, additionalpayments are applied to the end of the contract. The additional paymentsare applied in last installment to first sequence. Payments continueto be cycled due on the due date, but by applying the payment to theend of the contract, customers can pay off the contract in a shorteramount of time.Installmentpayment reversals are always applied in last installment to firstsequence.